ps88 HSBC finds PH in sweet spot

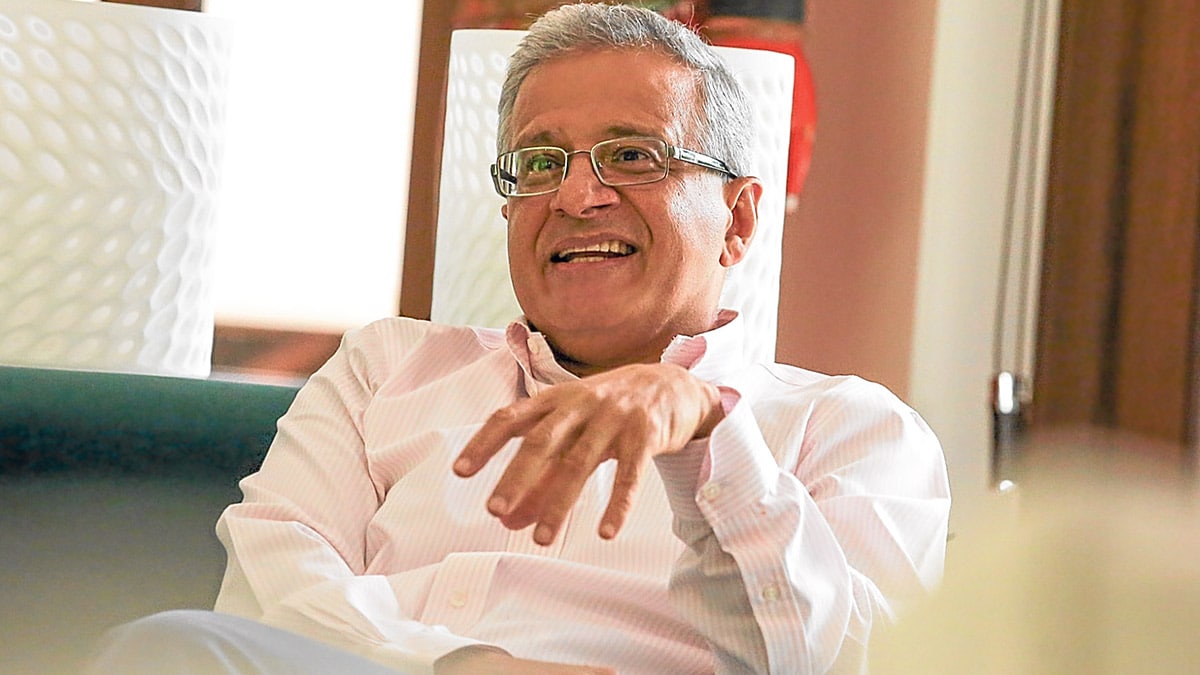

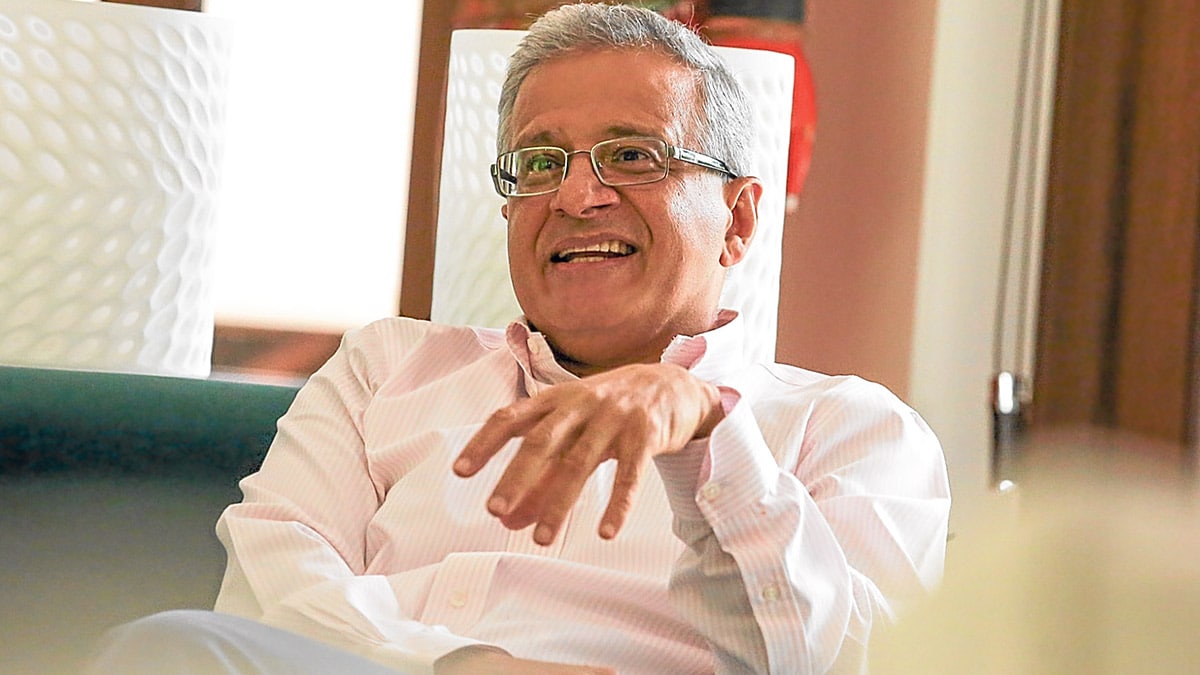

HSBC Philippines CEO Sandeep Uppal —Lyn Rillon

Back in 2012, British banking giant HSBC came out with a research saying that the Philippines could pole-vault to be the 16th largest economy in the world by 2050.

The COVID-19 pandemic may have set back everyone, but it hasn’t diminished HSBC’s optimism on this country.

Article continues after this advertisementLooking at how the country has fared in recent years, HSBC Philippines CEO Sandeep Uppal says, “It (economic backdrop) is like seeing a student’s report card, where everything is A+.”

FEATURED STORIES BUSINESS BIZ BUZZ: Low-key search for new PNB CEO on BUSINESS From noodles to cake to ‘lechon manok,’ Fruitas on buying spree BUSINESS Trump victory might prompt more BSP cutsHSBC expects gross domestic product (GDP) growth to pick up pace to 6.7 percent by 2026, the fastest in Southeast Asia.

“Credit growth, which has been low, is also going to start hitting 9 to 10 percent … Then, inflation will also be around 3 percent in the next few years, very much under control,” he says in a recent chat with the Inquirer.

Article continues after this advertisementDuring the pandemic lockdowns, many Filipinos saved less amid the challenging environment. But now, they have started to rebuild savings, seen to rise from 22 percent to 25 percent of GDP by 2026.

Article continues after this advertisementThe same is true with corporate Philippines. Once the economy reopened, businesses tempered expansion plans to rebuild cash reserves. By the time they were ready to expand, interest rates had gone up.

Article continues after this advertisement“Now I think one of the reasons that it’s looking good for the economy is that corporates are well-stocked. They are well-positioned to invest. Interest rates are coming down, so I think you’ll see a lot more investments going to, other than manufacturing, new malls [and] hotels being refurbished.”

Furthermore, he says foreign direct investment (FDI) inflows may double in the years ahead.

Article continues after this advertisement“If there’s no black swan event, it looks good for the economy in the next few years,” he adds.

Uppal believes that the country has done a reasonably good job in managing inflation postpandemic—by raising interest rates while avoiding an economic recession.

After a 9.6-percent GDP contraction in 2020, the economy grew by 5.7 percent in 2021, followed by a 7.6-percent and 5.5-percent expansion in 2022 and 2023, respectively.

“So the question for the economy is, if you’ve been so good with your growth rate with high interest rates, how much better will you do it with lower interest rates?”

Global commodity price shocks, coupled with the local currency depreciation and food supply constraints caused by typhoons, animal diseases and other natural disasters, drove consumer prices higher in the past two years.

But now that inflation is back to the target range of 2 percent to 4 percent, the Bangko Sentral ng Pilipinas has started cutting local interest rates. From 6 percent at present, HSBC expects the policy rate to go down to 5 percent by the end of next year.

Pharma manufacturingTo bring in more FDIs, Uppal believes one sector to target is pharmaceutical manufacturing, given that the Philippines imports 70 percent to 80 percent of pharma requirements.

“If you get more manufacturing of pharmaceuticals in the Philippines, it ticks a lot of boxes, plus our demographic [profile] is such that as we age, we will consume more pharmaceutical products,” he says.

“And the good thing about pharmaceutical [industry] is the higher value added. It gives rise to research. It doesn’t use that much land, because we have constraint on land [ownership by foreigners]. Maybe it’s not so much power-intensive,” he notes.

In July, HSBC helped organize a business mission to India, assisting the Philippine Economic Zone Authority to meet investors. They identified the two most promising sectors—pharma manufacturing and information technology processing.

Boosting pharma manufacturing will bring down the lofty prices of pharma products and help local consumers, he adds.

BPO growthBusiness process outsourcing (BPO) is also seen to continue growing. This is a sector that is less capital-intensive but whose value added is higher, he says.

“In services, you don’t need much FDI. You put in $1 million, the good part is most of the $1 million may sit in the country, but the better part is that the $1 million will generate $10 million of IT-BPO revenues. And that [amount] is all local value added and remains here,” he says.

While most countries can export manufactured goods, very few can export services, he says.

“The Philippines is in a good position. It’s got a level of scale now with 1.7 million people [employed in BPOs],” he says.

As multinational institutions put up global services processing hubs in the country, he says this will not only create more jobs but also allow technology transfer. HSBC is among those global institutions that have set up such a global hub in the Philippines.

Wanted: a deeper capital marketOne area that needs a bit more work, Uppal says, is deepening the local capital markets.

At present, he notes that most savings in the country are either going to bank deposits or invested in real estate, in turn inflating property prices.

Due to the lack of opportunities in the capital markets, he says a lot of local fund managers buy assets overseas but hedge in the form of peso-denominated funds that invest overseas.

He wishes for the country to have more domestic securities that are liquid. Having a robust pipeline of initial public offerings is seen to help attract more savers to become equity investors.

“I think it’s very important for the country to have a very active equity capital market, because then you generate the savings into equity and equity into productive assets like business. We don’t have that. If our savers are then buying peso-denominated overseas funds, then the capital is going overseas and not staying in the country,” he says.

Tourism has potential but…Uppal also agrees that the potential of tourism as an economic driver is huge. Think of Japan, a rich economy, from where 200,000 travelers go to the Philippines every year. However, Filipinos who visit Japan every year are three times more than that number!

For Uppal, flight connectivity is one of the key missing ingredients.

“Our flights are geared up for OFWs (overseas Filipino workers) and not for tourism. The routes where the OFWs are, we have very good flight connectivity; Middle East is a good example; [the United States] is a good example,” Uppal says.

“But if you think of it, some of the biggest markets in the developed world are [the United Kingdom] and Europe, where we have few direct flights,” he adds.

Recently, direct connectivity to Europe resumed with Air France offering nonstop flights from Manila to Paris thrice a week. But Uppal says there should be more nonstop flights to more destinations in Europe.

Another example is India, one of Asia’s growing outbound markets for tourism. Thailand and Vietnam are getting more and more tourists from populous India because they have direct flights. Even Cambodia is now starting direct flights, he points out.

Meeting his friends on a trip to India, Uppal gathered how challenging it is to travel to the Philippines. To get a tourist visa, Indian tourists need to go to the embassy to fill out forms and submit documents manually, whereas it’s all electronic to apply to travel to other countries like Singapore.

He adds that hotel rooms and flights to the Philippines are likewise relatively expensive.

Mobility is key“Quite often, a multinational corporation, or even local government asks us: Where do you see opportunity in Philippines? I give them one word, which is both an opportunity and a challenge—mobility … How do you move people? How do you move goods? How do you move electricity? How do you move water? How do you move data? A lot of the investment [needed] is under the very, very broad category of mobility,” he says.

Going back to the earlier example, he says India has been building eight new airports every year for the last 10 years, thereby doubling the number of aviation gateways to 157. It has also built around 6,000 kilometers of new highways each year in the last decade.

Hopefully, the same thing will happen in the Philippines, he says, where the government is looking to invest around 5 percent to 6 percent of GDP in infrastructure each year.

And HSBC will continue to do its share in helping the country—which aspires to graduate into an upper middle-income economy by 2025—meet its development objectives.

In the coming year, HSBC will celebrate its 150th year of operations in the country.

Subscribe to our daily newsletter

“It’s a very proud moment for HSBCps88, but I think it’s a very proud moment for Philippines also, that a global international bank has been on the ground for 150 years and has prospered over all 150 years and continues to invest and see still a brighter future after 150 years,” he says.

READ NEXT Recession-hit Argentina gripped by ‘Ponzidemia’ New training center in Bulacan to boost construction, technica... EDITORS' PICK PH addresses FATF concerns on money laundering Catholic Church assembly acknowledges ‘obstacles’ for women Storm floods spill over as stage for aid-bearing pols LIST: Water service interruptions in NCR, Rizal from Oct. 28 to 31 PH to lead next year’s World Health Assembly IN PHOTOS: Scenes of devastation as Kristine hits Philippines MOST READ Comelec: No excess ballots for 2025 polls Duterte expected as Senate drug war probe begins PhilHealth’s fault LIST: Water service interruptions in NCR, Rizal from Oct. 28 to 31 Follow @FMangosingINQ on Twitter --> View comments